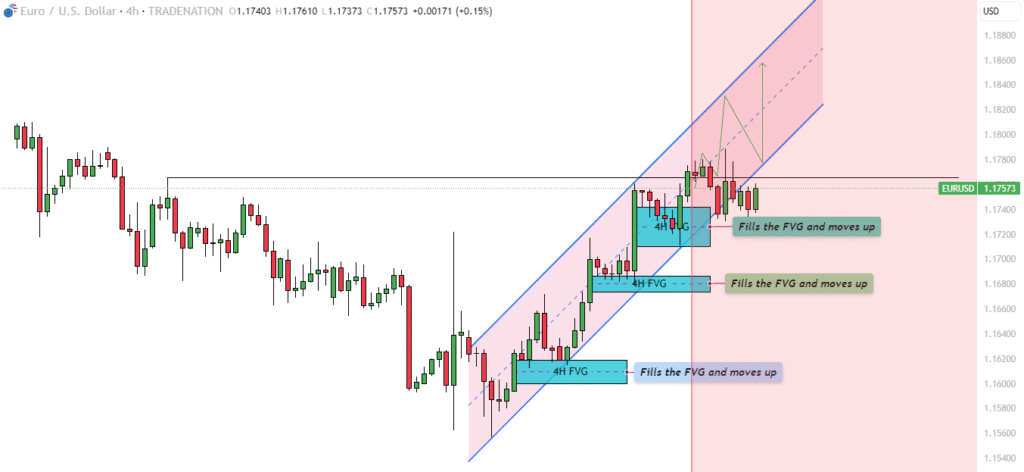

The EUR/USD currency pair is generating buzz in the forex markets with its clear bullish structure on the 4-hour chart. A consistent pattern of higher highs and higher lows within a well-respected ascending parallel channel is drawing the attention of swing traders and day traders alike. But what’s most interesting? The pair is repeatedly forming and filling 4-hour Fair Value Gaps (FVGs) — a behavior that could be a key signal of institutional activity.

Let’s dive deep into the EUR/USD 4H technicals, uncover the critical levels you should watch, and discuss how the current setup could lead to either a major breakout or a sharp reversal.

Current Market Structure: Inside the Bullish Channel

As of now, the EUR/USD continues to respect a textbook bullish parallel channel on the 4-hour timeframe. This ascending channel has acted as a reliable technical framework, with price action bouncing cleanly between the lower and upper trendlines. Each pullback is finding support near the bottom of the channel, while each rally slows near the top — indicating controlled, steady upward momentum.

This pattern of price behavior is commonly associated with market confidence and strong directional bias. It’s a bullish textbook example: higher highs, higher lows, and precision respect of support/resistance levels.

Fair Value Gaps (FVGs): The Hidden Fuel Behind the Moves

What adds fuel to this bullish fire is the consistent appearance of 4-hour FVGs during every bullish leg. These gaps — small inefficiencies created by sudden price movement — are often filled quickly as smart money reclaims unbalanced zones. In this case, the EUR/USD has retraced to fill every recently formed FVG before continuing higher, including the one filled earlier today.

FVGs are more than just gaps — they’re signs of institutional movement. When price returns to fill them and then resumes its original direction, it reinforces that large buyers are stepping in and keeping the trend alive.

Key Level: 1.1766 — The Gatekeeper to the Next Rally

While the overall momentum is bullish, traders should keep a sharp eye on the horizontal resistance at 1.1766. This level has acted as a barrier on multiple occasions. A confirmed breakout above it could trigger a fresh wave of bullish interest, with upside targets near 1.1820 and possibly higher — depending on how the channel holds.

If the price breaks and sustains above 1.1766, it would validate the ongoing bullish structure and may spark FOMO-driven buying, particularly from traders waiting for confirmation.

Bullish Outlook

- Continuation of the ascending channel

- Repeated FVGs being filled and respected

- Institutional activity supporting demand

- Target zones: 1.1820 and potentially 1.1850

Bearish Risk Scenario

Of course, no trend lasts forever, and this structure is not immune to failure. A bearish reversal scenario would play out in two stages:

- A false breakout above 1.1766, triggering bull traps.

- A breakdown below the ascending channel’s lower trendline.

Should this happen, the FVG support zone between 1.1710 and 1.1740 becomes critical. A failure to hold here could result in a deeper retracement — possibly dragging price toward 1.1680 and even 1.1650.

This would mark a significant shift in bias, from trend-following long trades to reversal setups.

Trade Ideas and Strategy Tips

- For bulls: Wait for a clean break and 4H candle close above 1.1766 for potential longs toward 1.1820+. Consider placing stops just below the latest FVG zone.

- For bears: Watch for rejection near the upper trendline or a false breakout above 1.1766. Short entries could be considered if price breaks and closes below the lower channel support.

Conclusion

EUR/USD is currently in a bullish rhythm, dancing perfectly within a rising parallel channel while systematically filling 4H Fair Value Gaps. The behavior is not random — it signals an organized market, likely driven by smart money. The 1.1766 resistance level is the next big test. Break it, and bulls may dominate. Fail, and bears could reclaim control.

This is a technical setup you don’t want to ignore.

FAQs

Q1: What is a Fair Value Gap (FVG)? A: An FVG is an imbalance or gap in price action where liquidity is low. It often gets filled quickly, acting as a magnet for price. In institutional trading, FVGs are key entry and exit zones.

Q2: Why is 1.1766 such a critical level for EUR/USD? A: It’s a horizontal resistance tested multiple times. A confirmed break and close above it suggests bullish strength and may lead to further gains.

Q3: How reliable is the ascending channel on the 4H chart? A: Very reliable so far — price has respected both trendlines cleanly. However, no pattern is perfect, and confirmation is key.

Q4: What would invalidate the bullish setup? A: A clean breakdown below the lower trendline of the ascending channel, especially if accompanied by a failure to hold the FVG support zone (1.1710–1.1740).

Q5: How should I trade this setup? A: Wait for confirmation. Trade breakouts with volume or reversals with tight risk. Use key levels — especially FVGs — to frame your entries and stops.

Disclosure: I am part of Trade Nation’s Influencer program and receive a monthly fee for using their TradingView charts in my analysis. This article is for educational purposes only and not financial advice.