Greetings, dear readers.

Today, I’m not just sharing a financial analysis — I’m sharing something deeper: a personal reflection on where we are right now as investors, traders, and humans in a rapidly changing world. As someone who has studied and participated in multiple Bitcoin market cycles, I believe we are entering the final stage of this current cycle — the distribution phase. And alongside this shift in crypto, we are also witnessing dramatic geopolitical and economic movements that could reshape everything in the coming months.

Global Tensions Signal Major Change

Let’s talk about the broader picture first.

We’re living in one of the most fragile global environments in decades:

- Trump’s re-election has reset the tone of American politics.

- Tensions between India and Pakistan, Israel and Iran, and Russia and Ukraine are escalating.

- China’s bold geopolitical plays are signaling a new era of global realignment.

There’s a lingering unease — a sense that we are on the verge of something historic. I hope I’m wrong, but the signs of a global conflict or economic reset are loud and clear. And based on what I’ve tracked over the years, September 2025 seems to be the moment everything converges — a critical turning point in the current financial market cycle.

Opportunity in Uncertainty: AI & Market Adaptation

Even in uncertain times, there are unparalleled opportunities — especially for those who adapt.

One of the biggest shifts I’ve embraced is the integration of artificial intelligence into my life and work. Whether you’re in finance, content creation, or tech — AI is no longer optional. It’s not just a tool, it’s the new foundation.

If you’re not using AI to streamline your workflow, predict market behavior, or automate decision-making — you’re already falling behind. I strongly urge every market participant to begin integrating AI today.

I’ve implemented AI deeply into both my personal productivity and trading systems, and I can say with confidence: the future belongs to those who evolve now.

The Changing Face of Crypto: From Innovation to Instability

Let’s address the elephant in the room — the cryptocurrency market.

Honestly? I’ve been disappointed in its trajectory over the past couple of years. What was once an innovative, explosive space has become:

- Seasonal and diluted in liquidity

- Dominated by hype cycles and short-term speculation

- A shadow of its former innovative self

Many promising projects from the 2017–2018 boom — like Dash, EOS, Litecoin, ZCash — have faded into near irrelevance. They still exist, but they no longer shape the market narrative.

This has led me, personally, to shift focus back toward Forex and gold — where I find transparency, consistent patterns, and more reliable opportunities.

Bright Spots: Solana & the Rise of RWA Tokenization

That said, not everything is bleak. Certain exceptions have proven that innovation still breathes within crypto:

- Solana is a rare success story — a project that leveraged the right momentum, technology, and community at the perfect time.

- But more importantly, the tokenization of real-world assets (RWA) is emerging as the next mega-trend in digital finance.

Whether it’s on Ethereum, Polygon, or any future chain, tokenizing real estate, commodities, and securities will revolutionize finance. With institutional players like BlackRock entering the space, this isn’t just another trend — it’s a full-fledged movement.

If you’re looking for the next 10-year opportunity in blockchain, look toward RWA.

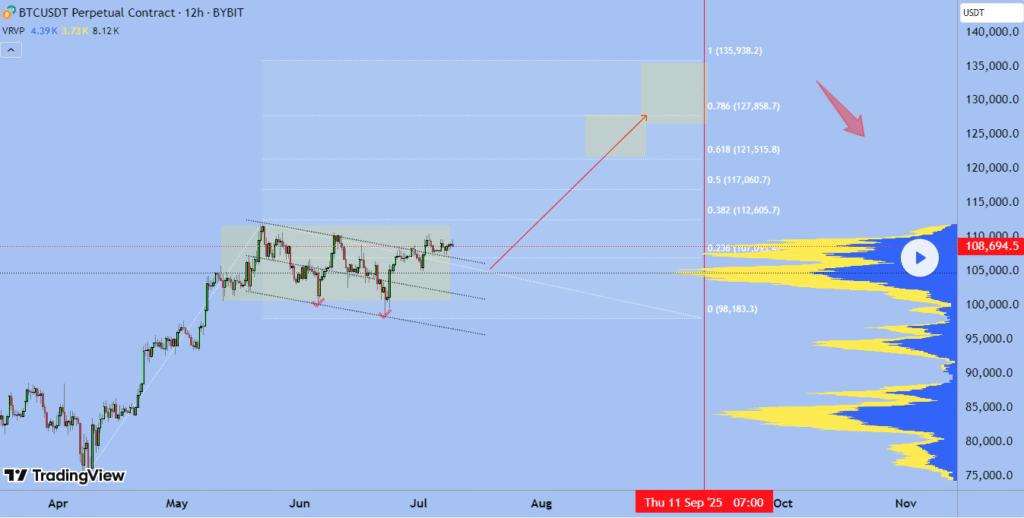

My Near-Term Market Outlook: Bearish Into the Reset

Despite the innovation, my short-term stance is bearish.

Why?

Because the economic conditions globally are unsustainable:

- Inflation is still a beast.

- Governments are printing more than ever.

- Geopolitical risk is at multi-decade highs.

- Recession signals are blinking red across key economies.

All this leads me to a strategic shift in my portfolio — away from high-risk altcoins and toward defensive, capital-preserving strategies until at least late 2025.

Are You Ready for What’s Coming?

Here’s the truth: the world is changing faster than ever. Between AI, global tensions, and a shifting financial paradigm, we are entering a new world — and there’s no going back.

Ask yourself:

- Are you prepared to adapt your strategy?

- Are you learning the skills that will matter tomorrow?

- Are you investing in tools and knowledge that position you for what’s next?

Personally, I’ve already made those moves — because waiting for clarity is no longer an option.

Final Thoughts: Stay Focused, Stay Human

To all who’ve followed my posts, thank you.

This isn’t just about charts, predictions, or profits — it’s about being present, prepared, and resilient in a world that’s shifting beneath our feet.

We’re all part of something bigger now. And while the road ahead may be filled with volatility, I believe it will also be filled with extraordinary opportunity — for those who stay focused, informed, and adaptable.

If you have ideas, questions, or want to collaborate — I’m always open to dialogue.

Let’s navigate this changing world together — with clarity, courage, and conviction.

Key Takeaways:

- September 2025 could mark a major global and market shift

- Bitcoin is in its distribution phase — upside is limited short-term

- AI adoption is essential for survival and success in the new economy

- Crypto markets are evolving — but many early projects are obsolete

- RWA tokenization is the next big opportunity

- Prepare now — the world will not wait

Wishing you success, security, and strength in the days ahead.

The time of change is here — let’s face it together.