Bitcoin, once the domain of renegade coders and Reddit-fueled dreamers, is going through a radical transformation. While retail investors clutch their coins like a golden ticket, some of the earliest whales are making quiet exits — just as institutional titans pile in with billion-dollar buys.

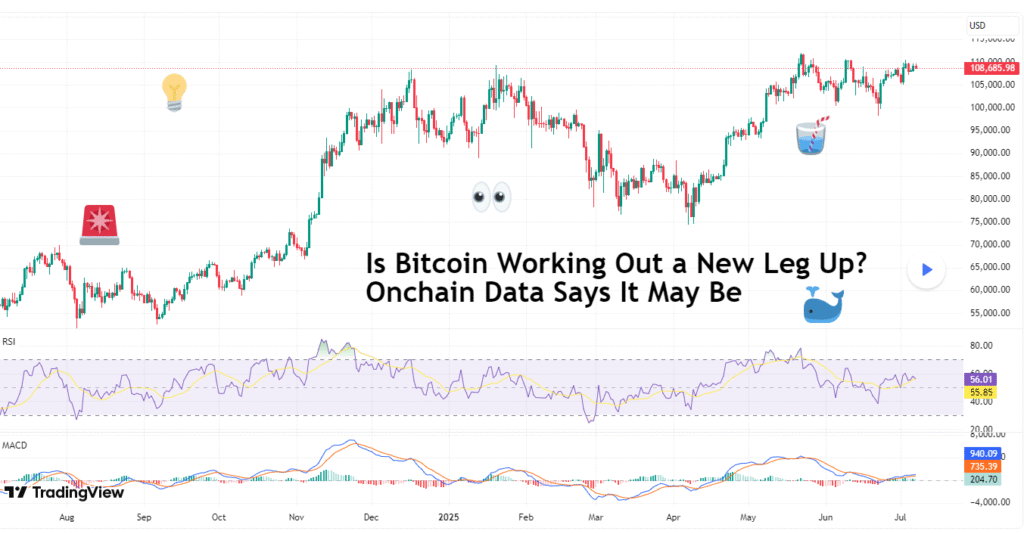

With BTC trapped in a consolidation range between $100,000 and $111,000, many are asking: Is this the calm before another explosive breakout? Or is the golden age of crypto moonshots fading into a slower, steadier era?

In this article, we dive deep into on-chain data, historic whale transactions, and market dynamics to uncover what’s really happening behind Bitcoin’s current price action—and why this “boring” phase might be anything but.

Whales Are Waving Goodbye — And It’s Not a Bad Thing

Over the past year, OG Bitcoin whales — the early adopters who mined or bought BTC for mere cents — have offloaded over 500,000 BTC, valued at more than $50 billion, according to 10x Research.

But rather than crashing the market, this historic sell-off has been met with eager hands from institutions: ETFs, corporate treasuries, and family offices that were crypto-skeptical just five years ago.

A Massive Hand-Off in Progress

This silent transition is one reason Bitcoin has been unable to break convincingly above $111K. The massive volume is being absorbed—but not chased.

Big players are no longer speculators—they’re allocators. That’s both bullish for Bitcoin’s long-term prospects… and frustrating for traders waiting on the next breakout.

Institutions Now Hold 25% of All Bitcoin

Institutions currently control around 25% of Bitcoin’s circulating supply, and their buying strategy is vastly different from retail FOMO or speculative pumps.

These new holders don’t trade on hype. They enter via spot ETFs, accumulate during dips, and hold for years—if not decades. This creates a more stable price floor but may also cap short-term upside volatility.

Why Breakouts Keep Failing

Each time Bitcoin inches toward a new high, it’s met by institutional order books designed to buy dips—not chase breakouts. This explains the current sideways grind between $100K and $111K.

From Hot Volatility to Cool Accumulation

Bitcoin’s volatility is shrinking—dramatically. For newer traders, this can be disheartening. But for long-term holders and corporate buyers, it signals maturation and market stability.

The crypto’s Wild West days aren’t over, but the sheriff’s definitely in town now. What was once a retail-fueled rocket ride is slowly becoming a Wall Street-friendly, inflation-resistant, global asset class.

On-Chain Data Reveals a Tightening Supply Squeeze

On-chain analytics show a continued trend: Bitcoin reserves on exchanges are falling, while holdings in cold wallets and ETF custody accounts are growing. This is classic accumulation behavior.

Why does this matter?

When supply tightens and demand remains stable—or increases—the price naturally grinds higher, even if not in explosive bursts.

Supply & Demand Equilibrium

Even though old whales are selling, their coins are instantly absorbed by institutional demand. This equilibrium is why Bitcoin isn’t crashing… or soaring.

Legendary Whale Moves: $7.8K to $1 Billion

Two wallets that bought 10,000 BTC each in 2011 for just $7.8K recently sprang back to life. After sitting dormant for over 14 years, both wallets moved their now $1.1 billion holdings within 30 minutes of each other.

Was it tax planning? Key recovery? Or a carefully planned exit strategy? No one knows.

But this move underscores one key point: Bitcoin rewards patience, conviction, and timing. These early investors waited over a decade—and walked away billionaires.

Why Bitcoin’s Stuck Between $100K and $111K

The $100K–$111K price range has become Bitcoin’s new “accumulation zone.” Here’s why this range is so sticky:

- Institutional Buy Walls at $100K

- Heavy Liquidation Zones at $111K+

- Even Distribution of Long/Short Leverage

- Sideways Whale Transfers instead of directional bets

These dynamics create ping-pong price action, making short-term breakouts difficult while long-term bullish structure remains intact.

The $1.1 Billion Time Capsule Move Isn’t the End

While some might see these whale exits as bearish, they actually represent a changing of the guard. Bitcoin is evolving into an intergenerational store of value. It’s not about sudden 10X returns—it’s about capital preservation, scarcity, and future-proofing portfolios.

Crypto Fear & Greed Index: Currently in ‘Greed’ – But Not Mania

The Crypto Fear and Greed Index is currently reading 66—a sign of optimism, but not euphoric FOMO. Historically, Bitcoin bull runs peak when this index reaches 80+ for several weeks.

Interpretation:

- Still room to run

- Not yet overbought

- Accumulation phase remains in full effect

So… Is This Bullish or Bearish?

The answer? Yes.

- Bullish if you’re long-term, patient, and value stability.

- Bearish if you’re seeking quick flips, moonshots, and hype pumps.

- Neutral if you’re watching the handover unfold without jumping in.

Either way, this is one of the most important transitions in Bitcoin’s 15-year history.

What Comes Next? The Case for $150K in 2025

The stars may still align for Bitcoin to break above $150K before the end of 2025. Here’s what needs to happen:

- Continued ETF inflows

- 200-week SMA crossing previous ATH

- Institutional FOMO if rate cuts begin

- Retail re-entry during breakout confirmation

Until then, Bitcoin may keep consolidating in this mega-range — building the base for its next leg.

Final Thoughts: Bitcoin Isn’t Boring, It’s Growing Up

Bitcoin is no longer a fringe asset. It’s becoming the digital gold of our generation, used by pensions, endowments, and billionaires alike.

Yes, that means fewer rollercoaster moments—but it also means Bitcoin has finally earned its place in the world’s financial ecosystem.

So the question isn’t “Will Bitcoin explode again?” — it’s “How long can you wait for it?”

Conclusion

Bitcoin is undergoing a major shift — early whales are exiting while institutions quietly accumulate. This supply handover is keeping BTC range-bound near $100K–$111K. Though short-term volatility is low, long-term fundamentals remain strong. The next big move could come once accumulation ends and demand outweighs supply. Bitcoin isn’t slowing down — it’s growing up.

FAQ’s

1. Why is Bitcoin stuck between $100K and $111K right now?

Bitcoin is in a phase of heavy accumulation. Early whales are selling while institutions are steadily buying. This has created a balance between supply and demand, leading to sideways price action. Until this transition completes or demand spikes, breakouts may remain muted.

2. Are institutions really buying that much Bitcoin?

Yes. As of mid-2025, institutions — including ETFs, corporate treasuries, and family offices — now hold around 25% of all circulating Bitcoin. This marks a significant shift from retail-driven markets to long-term institutional holdings.

3. What happens when early Bitcoin whales sell?

When OG whales — those who bought or mined Bitcoin in the early 2010s — sell, it creates large supply injections. However, institutional buyers have been absorbing these sales, preventing a major crash and keeping the price stable.

4. Is the current accumulation phase bullish or bearish?

It’s bullish in the long-term, though it may seem boring in the short-term. Accumulation usually precedes breakout phases. As supply tightens and long-term holders lock up their BTC, the potential for a sharp upward move increases.

5. What does on-chain data say about Bitcoin’s supply?

On-chain metrics show declining exchange reserves, meaning fewer Bitcoins are available to trade. At the same time, more coins are being moved into cold storage and ETF custody wallets — a classic signal of accumulation.

Aw, this was an incredibly good post. Finding the time and actual effort to produce a

good article… but what can I say… I put things off a lot and never manage to get anything done.