Bitcoin (BTC) is once again dominating headlines after smashing through the six‑figure mark in mid‑2025. But is this just the middle of the move—or the top? In this deep‑dive we merge multi‑timeframe technical analysis (monthly, weekly, daily, 4‑hour) with critical on‑chain metrics to answer the questions every trader is asking:

- Is the 2025 Bitcoin bull market running out of steam—or winding up for its next explosive leg?

- Where are the key support levels that must hold for the trend to remain intact?

- What price target makes sense for 2025, and how high could BTC realistically climb before a major reversal?

Read on for the full roadmap, complete with actionable insights you can use today.

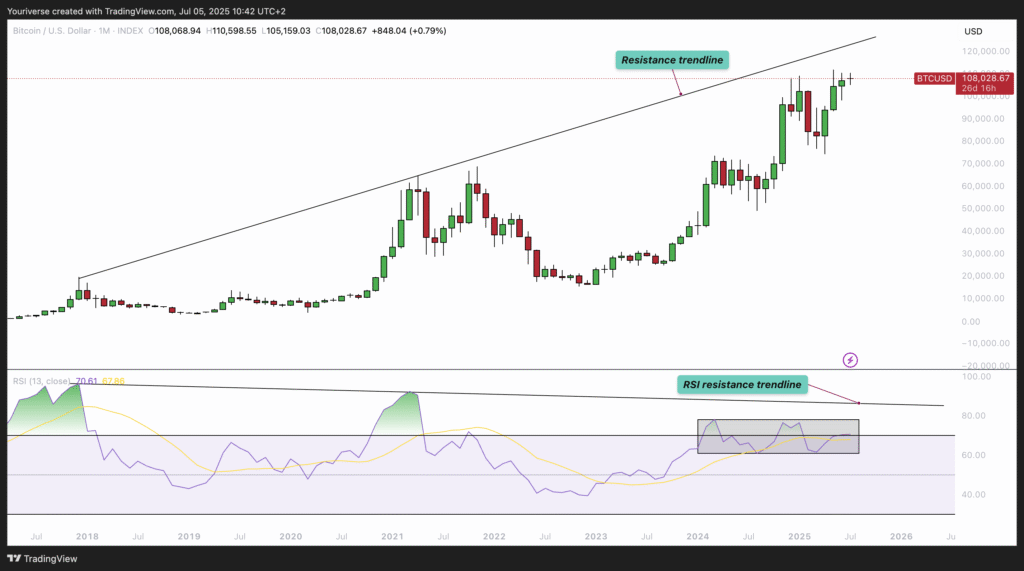

1. Monthly Logarithmic Channel: Aiming for the Upper Rail

On a log‑scaled monthly chart, Bitcoin has respected a rising, curved channel since 2013, with each cycle topping out at the upper boundary and bottoming at the lower boundary.

- Price Context: As of July 2025 BTC trades near $108 k, hugging a steeper “bull‑market support trendline” that emerged from the 2022 capitulation low.

- Key Zone: The $150 k region intersects the channel’s resistance arc. Historically, first contact with this upper rail has triggered cycle tops or at least multi‑month consolidations.

- Implication: The structural path of least resistance still points higher, but traders should watch reactions as price approaches $145–160 k.

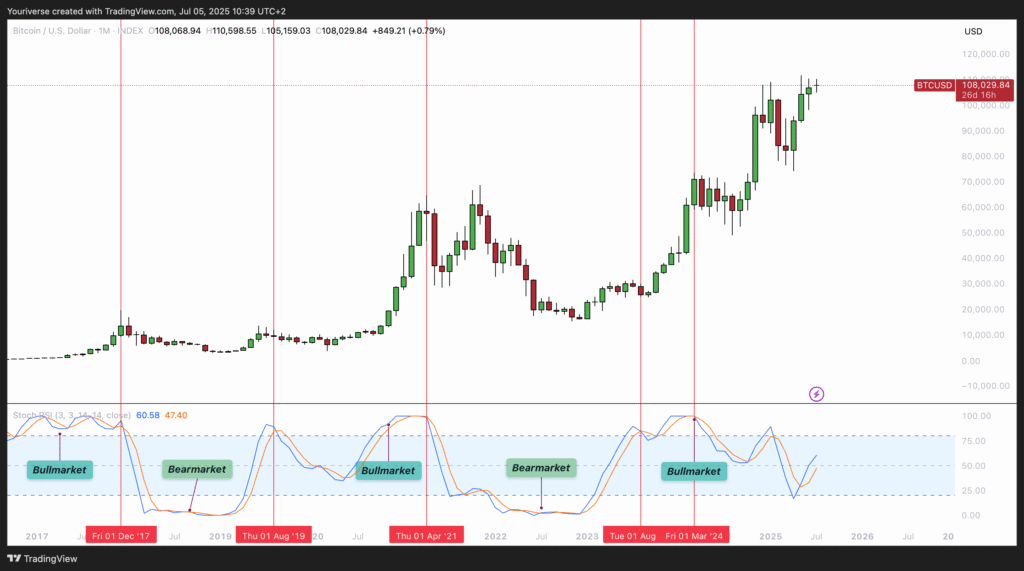

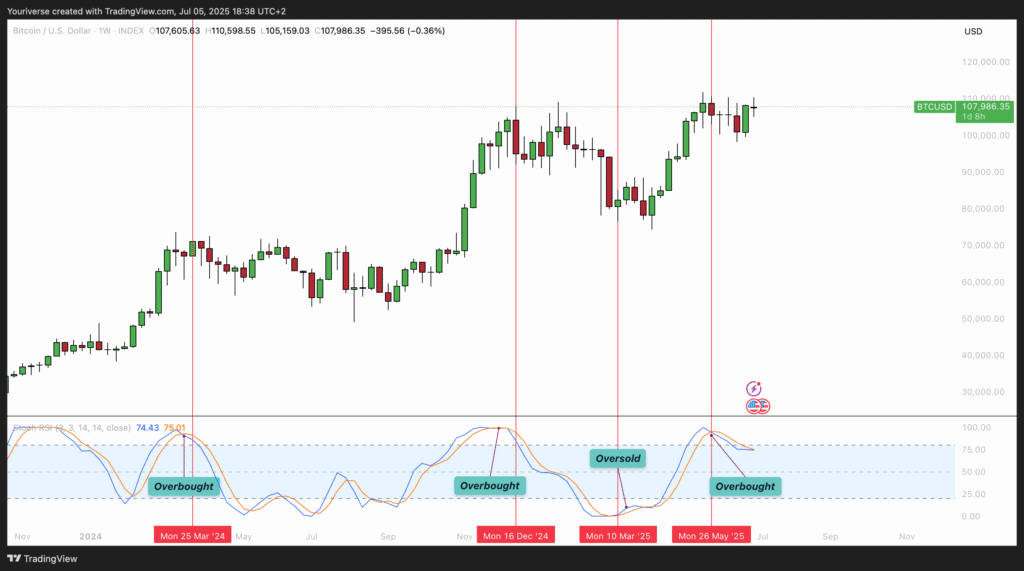

2. Monthly Momentum: Stoch RSI & Classic RSI Still Have Room

Stoch RSI Crosses

The monthly Stochastic RSI has flipped bullish, rising from oversold (<20) to fresh highs still shy of the extreme 100 level. In previous cycles, a cross above 80 preceded blow‑off tops by several months—not days—suggesting upside potential remains.

RSI Trendline Test Pending

A descending RSI resistance line connecting the 2017 and 2021 peaks currently sits near 78. Bitcoin’s momentum sits in the mid‑70s, implying the market has not yet reached “textbook exhaustion.”

- Takeaway: Momentum favors further upside, but once monthly RSI tags that long‑term trendline, expect volatility to spike.

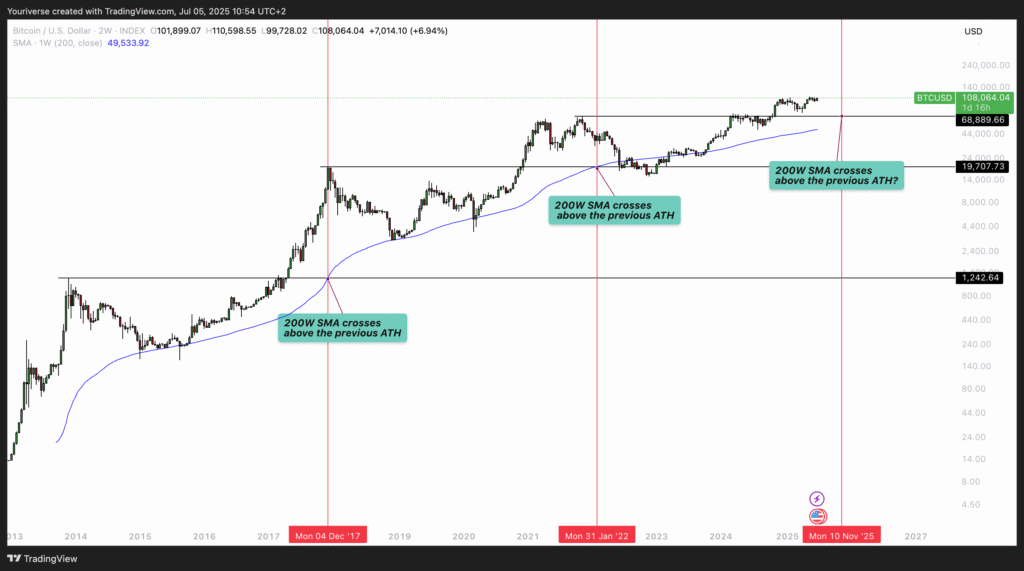

3. 200‑Week SMA vs. Prior ATH: The Classic Cycle Trigger

Historically, the long‑term 200‑week simple moving average (SMA) crossing above the previous ATH has coincided with final surge territory.

- Status: In 2025 the 200‑week SMA—now near $66 k—has not yet overtaken the 2021 ATH (~$69 k).

- Interpretation: Either price rallies further first, or we chop sideways long enough for the SMA to catch up. Either way, the historical “cycle‑top crossover” has not fired, hinting the current bull leg could extend into late‑2025.

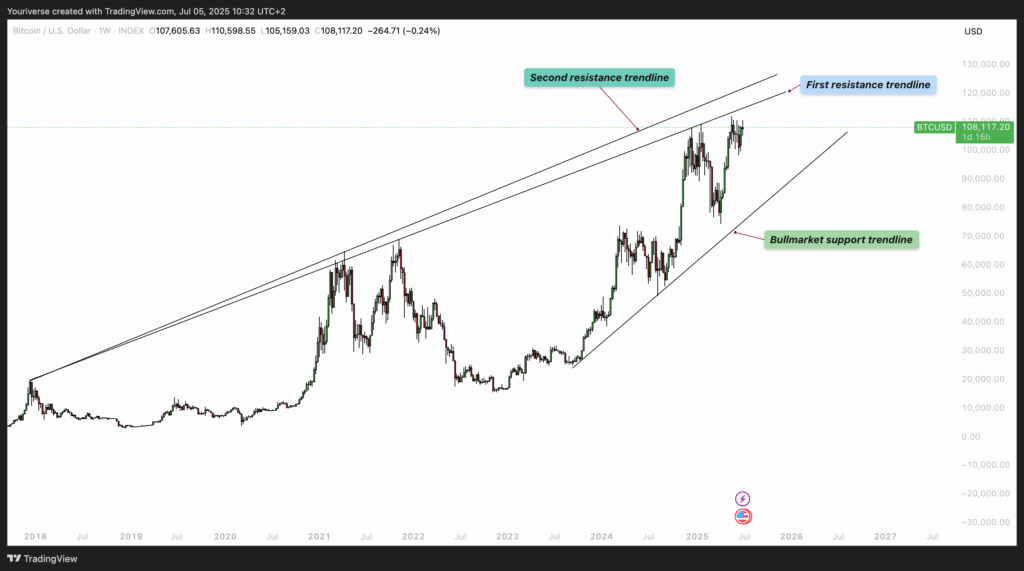

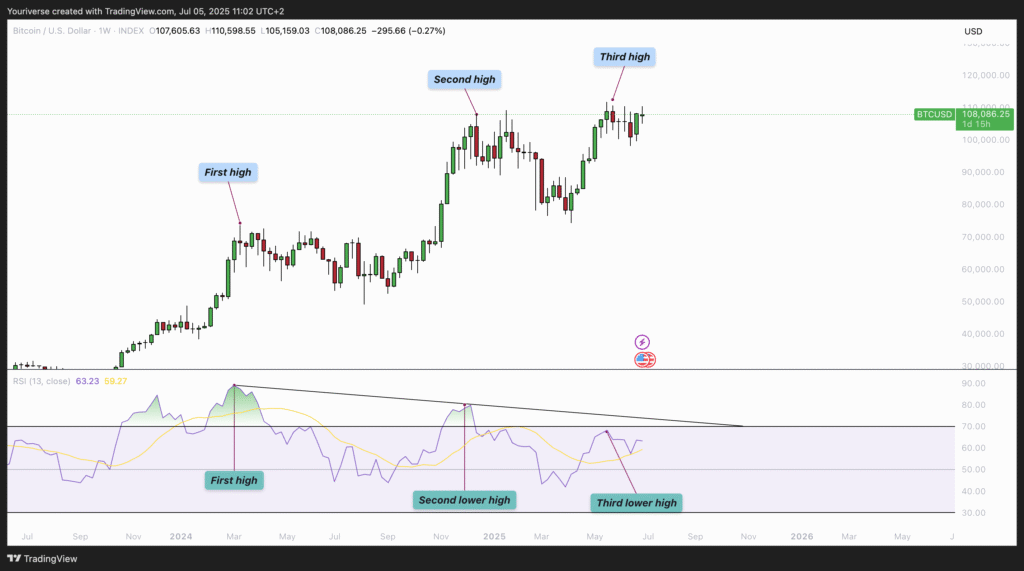

4. Weekly Chart: Rising Support vs. Bearish Divergence

Rising Bull‑Market Support

Since late 2022 BTC has consistently put in higher lows along a clean, upward‑sloping trendline—your line in the sand. A weekly close beneath it would mark the first structural failure of the cycle.

Bearish Divergence Red Flag

Price has printed three higher highs while weekly RSI has carved lower highs—a classic bearish divergence. This often precedes deeper pullbacks, but divergence alone rarely ends a primary uptrend without a clear breakdown of support first.

- Translation: The next marginal higher high (if any) needs strong follow‑through; otherwise a deeper correction to the rising support could unfold.

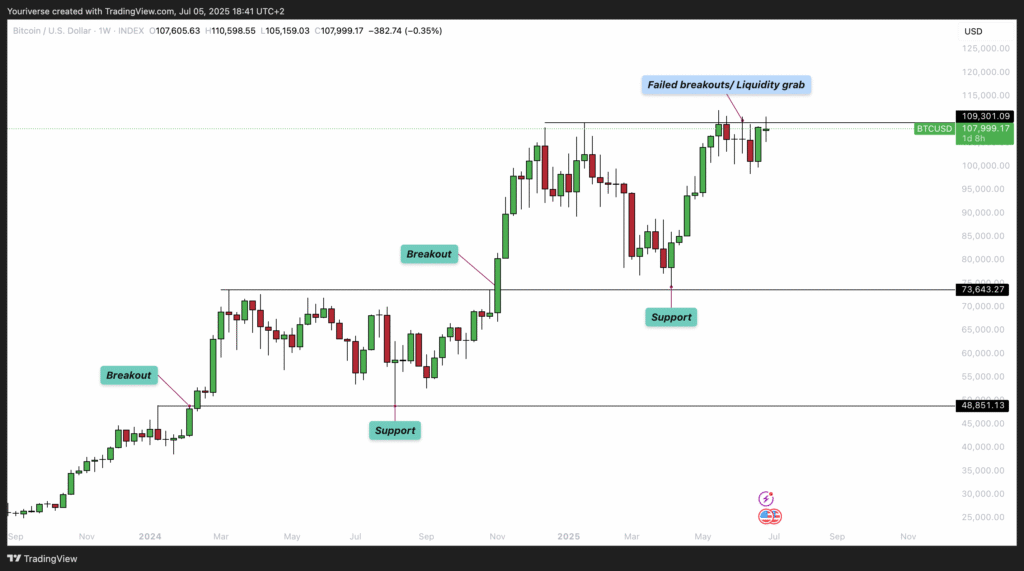

5. Daily Chart: Bull Flag Fake‑Out & Overheated Stoch RSI

A textbook bull flag broke upward earlier this week, but buying power fizzled and price slipped back into the prior range—an early sign of potential distribution.

- Stoch RSI: firmly overbought on the daily, echoing caution flagged on the weekly.

- What to Watch: Failure to reclaim the breakout level quickly (<$110 k) increases odds of a sweep of local liquidity down toward $100 k–$102 k (the flag’s mid‑range).

6. 4‑Hour View: Liquidity Pools & Fair‑Value Gap (FVG)

On the intraday chart BTC tagged equal highs near $110.6 k, an area loaded with short‑seller stops. That wick suggests a liquidity grab—not genuine breakout strength.

Below, a bullish FVG sits just under $105 k. If price can rebalance in that gap and hold, another assault on the highs—and the larger $111–114 k liquidation cluster—becomes probable.

- Scenario A (bullish): Hold FVG ➜ break 110.6 k ➜ accelerate toward 114 k and beyond.

- Scenario B (bearish): Lose FVG ➜ hunt liquidity to $100 k and test weekly trendline.

7. On‑Chain Confirmations: Supply Squeeze in Motion

Exchange Reserves at Multi‑Year Lows

Data from CryptoQuant shows exchange BTC balances have fallen persistently since mid‑2023. Fewer coins available on trading venues equals a thinner supply wall when demand spikes—classic rocket fuel for parabolic moves.

Sentiment: Greed but Not Euphoria

The Crypto Fear & Greed Index prints 66 (Greed). Historically, true cycle tops align with readings above 80 (Extreme Greed). Current sentiment suggests optimism, not mania—room remains before capitulation‑level exuberance sets in.

8. Price Target & Risk Map for 2025

| Path | Trigger | Objective | Risk Level |

|---|---|---|---|

| Bull‑Base | Hold weekly support & clear 110.6–114 k liquidity | $135–150 k (upper log channel) | Medium |

| Over‑Shoot | Convincing monthly close above 150 k with RSI breakout | $180–200 k blow‑off | High (sharp reversal likely) |

| Mid‑Cycle Dip | Weekly close below rising trendline / lose $100 k | Retest $80–85 k (200‑W SMA magnet) | Medium‑High |

| Bear‑Flip | 200‑W SMA crosses prior ATH during price weakness | Extended bear to $55–65 k | Low (for now) |

Base Case: A thrust into the $140–150 k zone in Q3–Q4 2025 fits historical channel behavior, 200‑week SMA math, and current on‑chain supply squeeze.

9. Trading & Investment Checklist

- Stick to the Trendline: As long as weekly candle bodies respect the rising bull‑market support, lean bullish.

- Monitor RSI Trendline Tests: Monthly RSI rejection at its macro trendline often signals final phase.

- Track Exchange Flows: A sudden spike in exchange inflows could mark distribution—watch Glassnode/CryptoQuant dashboards.

- Scale Out into Euphoria: If the Fear & Greed Index posts multiple weekly closes >80 and price kisses the log‑channel top, consider trimming exposure.

- Plan for Volatility: Wide daily ranges above $120 k will shake out weak hands—size positions accordingly.

Conclusion: Too Late to Buy—or Just in Time?

With BTC already past $100 k, newcomers fear they are arriving at the tail end. Yet the technical and on‑chain evidence paints a different picture:

- Supply shock continues as coins flow off exchanges.

- Momentum on higher timeframes has not reached historic exhaustion.

- Key cycle markers (200‑week SMA crossover, extreme sentiment) remain untriggered.

None of this guarantees a straight line up—Bitcoin’s corrections can erase 20–30 % in days. But in the absence of confirmed breakdown signals, the data tilts toward a final leg targeting $135 k–$150 k and, in a euphoric overshoot, possibly $200 k.

So, is it too late to invest? For disciplined traders with risk management—and a clear exit plan—the biggest move of the 2025 bull run may still lie ahead.

FAQs

1. What is the realistic price target for Bitcoin by the end of 2025?

Most credible forecasts cluster between $135 k and $150 k, which aligns with Bitcoin’s long‑term logarithmic resistance channel. A euphoric overshoot toward $180 k–$200 k is possible if supply‑shock dynamics intensify and sentiment reaches “Extreme Greed.”

2. How important is the 2024 halving to the 2025 price target?

Historically, the 12‑to‑18‑month window after a halving delivers the bulk of a cycle’s upside. The April 2024 halving cut new BTC issuance in half, creating a supply squeeze that should peak in late‑2025—right when many models project price to challenge the $150 k zone.

3. Is it too late to invest in Bitcoin now that it’s above $100 k?

Not necessarily. Technical markers that signaled prior macro‑tops—such as the 200‑week SMA crossing the previous ATH or Fear & Greed readings >80—have not yet triggered. However, volatility is amplified at these levels, so position sizing and disciplined stop‑losses are essential.

4. What are the biggest risks that could derail the 2025 bull run?

- Regulatory shocks (e.g., an unexpected U.S. ban on self‑custody or harsh tax rules).

- Macro liquidity crunch—rapid rate hikes or a credit crisis could force broad risk‑asset liquidation.

- Exchange hacks or insolvencies that undermine market confidence.

- Failure of weekly trendline support near the $95 k–$100 k region, which would flip technical bias bearish.

5. How can I tell when the market is getting overheated?

Watch for a confluence of signals:

- Fear & Greed Index above 80 for multiple weeks.

- Monthly RSI testing its long‑term down‑sloping resistance line (>78).

- Parabolic price acceleration—daily candles expanding 8–10 % back‑to‑back.

- Mainstream media mania (Bitcoin on front pages, celebrity endorsements, etc.).

When three or more of these flash red simultaneously, consider scaling out.